Fraud and Compliance

How Can AP Automation Ensure Government E-Invoicing Compliance?

In today’s fast-paced business world, manual invoicing can be a significant bottleneck. These manual processes are time-consuming, prone to human error, and often costly.

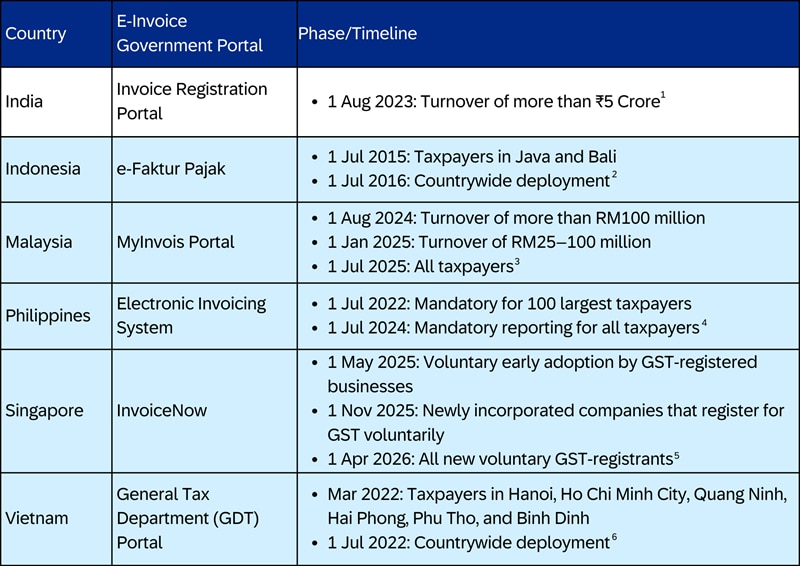

Across Southeast Asia and India, tax administrations are pushing for invoice digitization through regulatory changes. An increasing number of governments have a designated e-Invoicing portal to improve tax compliance, making it crucial for businesses to make the transition. Since 2022, India’s Invoice Registration Portal has acted as a digital platform to register tax invoices by generating a unique Invoice Reference Number and QR code, ensuring real-time reporting. As of 1 August 2023, e-Invoice is mandatory for businesses whose annual turnover is more than ₹5 Crore.

AP automation offers a solution that streamlines invoicing, enhances efficiency, and ensures compliance with evolving regulations, especially in Asia. Additionally, integrating e-Invoices directly into government portals minimizes errors, shortens the tax return process, and provides real-time insights into their data. This shift is not just about efficiency; it’s also about staying relevant and competitive.

How Government Mandates on E-Invoicing Affect You

Government regulations on e-Invoicing aim to simplify tax reporting and improve compliance as part of their digitization efforts. Taxpayers will need to understand these changes and align their invoicing teams and processes.

1Mandatory GST e-invoicing for taxpayers exceeds threshold limit of INR 5 crore | IndiaFilings

2Electronic invoicing in Indonesia | EDICOM Global

3Guide to e-Invoicing in Malaysia: Everything You Need To Know | BDO

4Mandatory E-Invoicing in the Philippines. Is Your Company Ready? | Comarch

5InvoiceNow | IMDA

6Regulatory updates – Vietnam | Pagero

Non-compliance with these mandates and missing submission deadlines can lead to severe penalties, including hefty fines and operational restrictions. These penalties underscore the urgency for businesses to adopt AP automation to ensure compliance and avoid costly consequences.

How SAP Concur and Staple AI Can Help Your Business

SAP Concur’s extensive and diverse partner ecosystem, comprising over 700 partners worldwide, empowers businesses to achieve their full potential.

The collaborative partner network value-add to our solutions to solve today’s business challenges. To help customers seamlessly navigate the complexities of today’s e-Invoicing demands, SAP Concur has partnered with Staple AI to ensure that companies comply with government e-Invoicing mandates in Southeast Asia and India.

Our integrated solution can handle multiple invoices at once, making the e-Invoicing process more efficient, reducing errors, and ensuring compliance with local regulations. Our solution eliminates manual data entry by validating information in real time and directly integrating with government platforms.

For businesses dealing with international vendors, manually extracting information in different languages and formats is time-consuming. Our solution supports over 90 languages, including Asian ones and simplifies this process by using a single, trusted partner. With the help of AP automation, the solution captures and structures data on the SAP Concur platform for easy viewing and verification.

By leveraging the combined strength of SAP Concur and Staple AI, your business can stay ahead and confidently manage end-to-end document processes.

Visit the Staple AI’s App Center page to explore how the solution can help your business automate, digitize, and accelerate the invoice management process through compliance, fraud reduction, and customization. Schedule a demo or speak with one of our experts today!